The Economics of Pilot Training: Analyzing the Demand and Supply Dynamic

By Alan Rios, Head of Capital Markets

The aviation industry is one of constant evolution, growth, and even occasional setbacks (9/11, Covid-19, Global Financial Crisis, etc.). But, it presents a unique landscape where the demand, and supply, for skilled pilots intersects with the practicalities of pilot training. This article delves into the economic forces at play in the pilot training sector, offering insights into both the demand and supply sides of the equation.

The aviation industry is experiencing a significant upsurge primarily driven by a global increase in air travel demand. According to the U.S. Government Accountability Office (GAO) in their Supply of Airline Pilots and Aircraft Mechanics report, “publicly available data on hiring, employment, and wages indicate strong current demand for pilots. Meeting that demand has been particularly difficult for regional airlines—which generally serve smaller communities—and has, according to them, affected their operations.” A forecast by the World Airport Traffic Forecasts 2023 – 2052 also shows that “by the end of 2024, global passenger traffic is expected to reach 9.7 billion, surpassing the 2019 level for the first time since the COVID-19 pandemic”. This growth is not just limited to passenger travel; it also encompasses cargo and freight transportation which has seen a surge due to the globalization of trade. As airlines expand their fleets to accommodate this growing demand, the need for qualified pilots has escalated correspondingly.

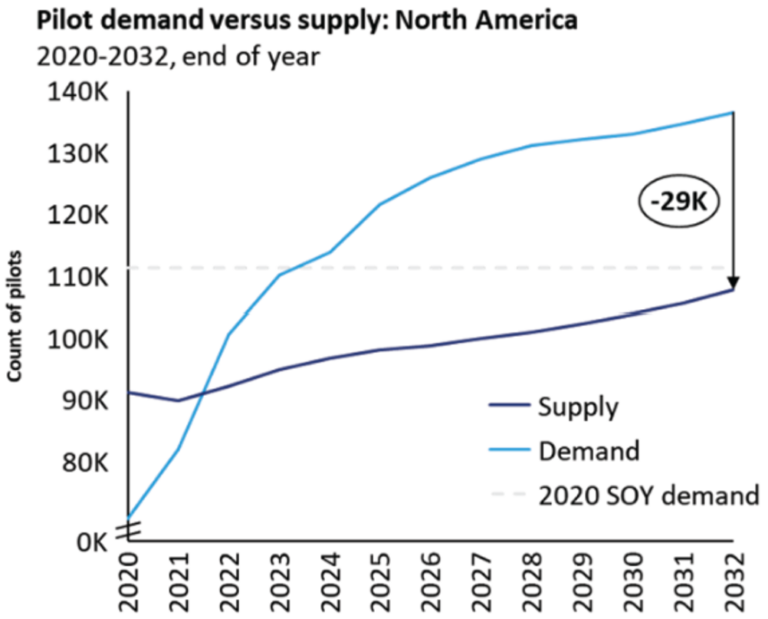

Airline hiring trends are a critical factor in the demand for commercial pilots. With a significant portion of the current pilot workforce nearing retirement age, there is an impending need to replace them. The U.S. Government Accountability Office (GAO) estimates that approximately 15 percent of current ATP certificate holders will turn 65 by 2027; 32 percent by 2032; 47 percent by 2037; and 61 percent by 2042. As it stands today, demand for pilots significantly outstrips supply in North America according to consulting firm, Oliver Wyman. They published the chart below which projects the shortage lasting well into the end of the decade.

Moreover, airlines are not just looking to fill existing positions but are also planning for future expansions. The introduction of new routes, especially in underserved regions, requires additional pilots. Furthermore, the trend towards more efficient, smaller aircraft for regional routes has led to a different set of requirements for pilot expertise, thereby influencing the demand for specific training and skills.

On the supply side, flight schools are the main channel through which new pilots are minted. Historically, a significant portion of commercial pilots transitioned from military backgrounds, leveraging their extensive training and experience for careers in commercial aviation. But over the last decade or two, the proportion of pilots coming from the military has significantly decrease. The journey to becoming a commercial pilot is not only rigorous but also expensive. The costs associated with pilot training, from ground school to flight hours, can be prohibitively high for many aspiring pilots. Since federal funding, such as FAFSA, is not available to private, non-collegiate flight schools, financial companies that specialize in private lending are crucial. By providing accessible financing options, these companies enable more students to pursue pilot training, effectively expanding the supply of trained pilots.

Regulatory requirements also play a pivotal role in shaping the supply for pilot training. Aviation authorities worldwide have been implementing stricter safety and training standards in response to the increasing complexity of modern aircraft and the diverse range of operational environments. For example, after an accidental plane crash in 2009 in NY that claimed the lives of all onboard, Congress instituted the1,500-hour rule which required all pilots to earn a minimum of 1,500 real world flight hours before being allowed to work for an airline. Other standards also include more comprehensive training on new technologies, advanced navigation systems, and enhanced safety protocols. Additionally, there is an increased emphasis on continuous education and recurrent training for pilots, ensuring that they remain adept at handling the evolving challenges of the aviation industry.

The economics of pilot training, and thereby pilot supply, is dynamic and an important aspect of the aviation industry. Understanding the demand and supply dynamics is crucial for airlines, aspiring pilots, flight school owners, and investors alike. For those looking to invest in this landscape, looking for financial solutions that solve the unique challenges of pilot supply is a critical step. Whether its investing in flight schools, pilot training, or leasing/selling aircraft to flight schools, investors should always be aware that supply and demand for air travel (commercial, private, charter, cargo, etc.) is the ultimate driver.

For more information about investing in the future of aviation through Stratus Financial Fund I, please visit us at become an investor or schedule a call at [email protected] today.